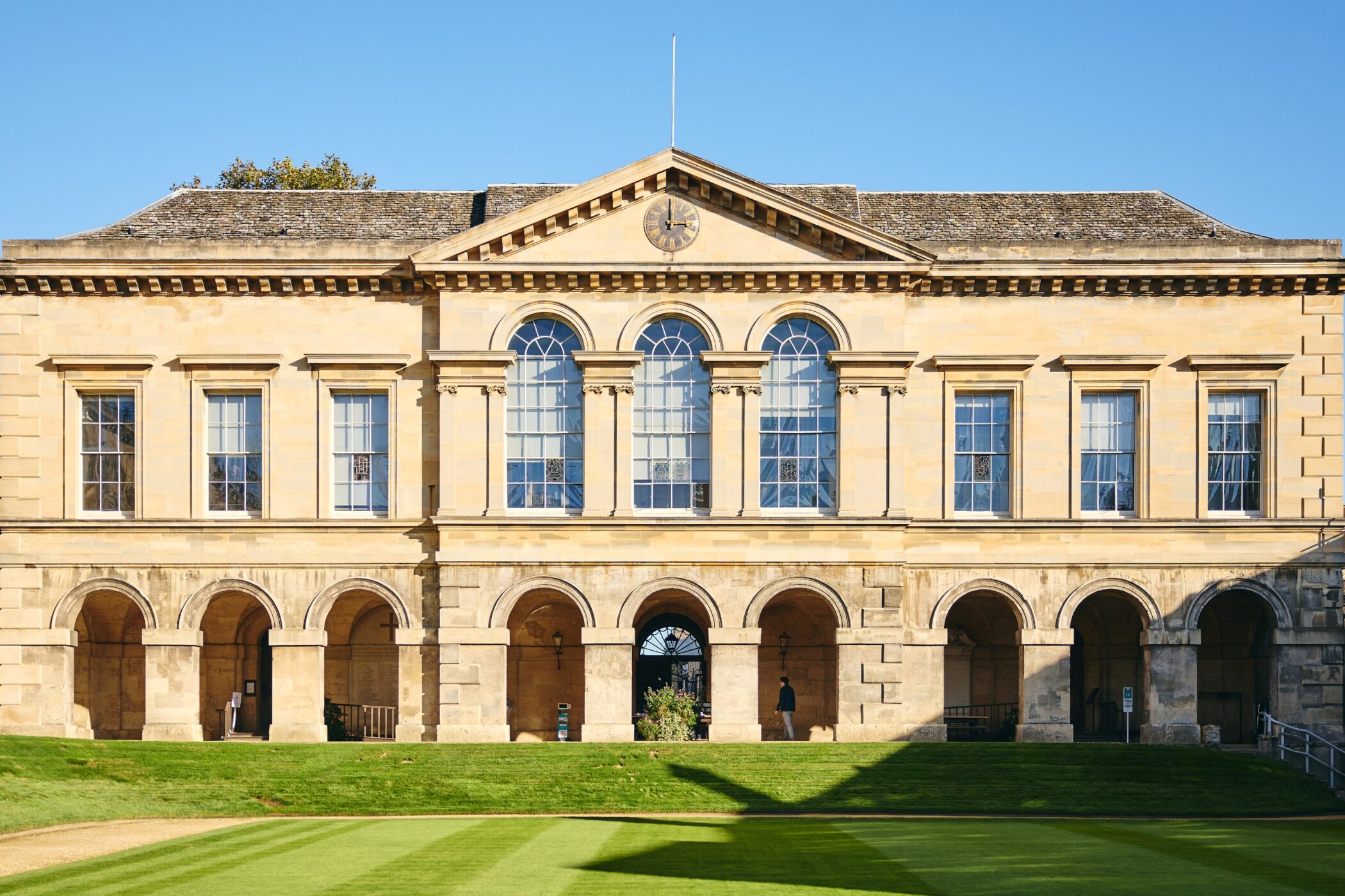

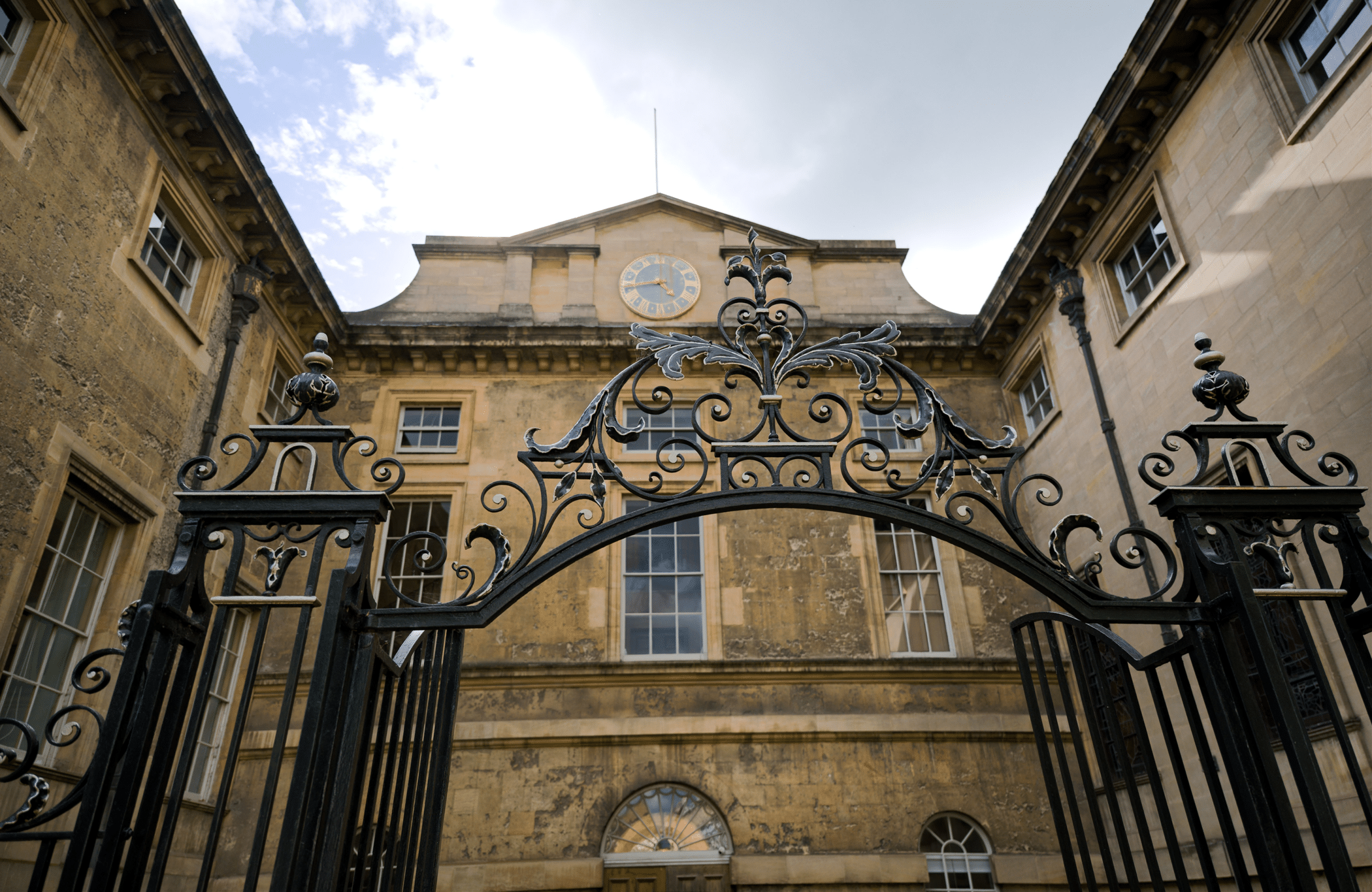

Giving a gift in your will allows you to do lasting good in the world. Whether you would like to support an area of College life close to your heart, or to remember someone important with a gift in their memory, by leaving a legacy you can play your part in Worcester’s future.

We promise we will always treat you and your gift with sensitivity and respect. We understand that leaving a gift in your will is very personal, and that your family and friends will come first. If you would like more information or a conversation to talk through your plans, please contact Millie Papworth at millie.papworth@worc.ox.ac.uk or 01865 278335.

Worcester was founded in 1714 thanks to a legacy of £10,000 from Sir Thomas Cookes. Since then, generous Old Members have continued this tradition. We are immensely grateful to everyone who remembers their ‘home from home’ like this.

How do I leave a gift in my will?

What types of gift can I leave?

Will leaving a gift in my will lower Inheritance Tax paid?

SAYING THANK YOU

The 1714 Society exists to say thank you to everyone we know of who has left a gift to Worcester College in their Will, or who intends to remember us in their estate planning. We hold an annual 1714 Society event to thank you for your far-sighted generosity, to share our plans for the College’s future with you, and to hear your feedback.

We know that the 1714 Society event will not be for everyone. If you would rather attend another event during the year, like the Donors’ Garden Party, please email or telephone Millie Papworth (millie.papworth@worc.ox.ac.uk or 01865 278335).